Choosing the Right Bank for Your Business: Exploring Business Account Options

Chris Barrett

Introduction

Starting a new business involves numerous decisions, and selecting the right bank is among the most critical. The choice of a banking partner can significantly impact your business’s financial health, affecting everything from daily transactions to securing loans. With a plethora of business account options available, it’s essential to understand which type aligns best with your business model and goals.

Understanding Your Business Banking Needs

Before diving into specific banking options, assess your business’s unique requirements:

-

Transaction Volume: Estimate the number of monthly transactions to determine if you need an account with unlimited transactions or if a limited plan suffices.

-

Cash Handling: If your business deals heavily in cash, prioritize banks that offer convenient cash deposit options.

-

Lending Needs: Consider whether you’ll need loans or lines of credit, as some banks have more favorable lending policies for small businesses.

-

Digital Tools: Evaluate the importance of online banking features, such as mobile apps, integrations with accounting software, and user-friendly interfaces.

-

Customer Support: Decide if personalized customer service is a priority, which is often more accessible through local banks.

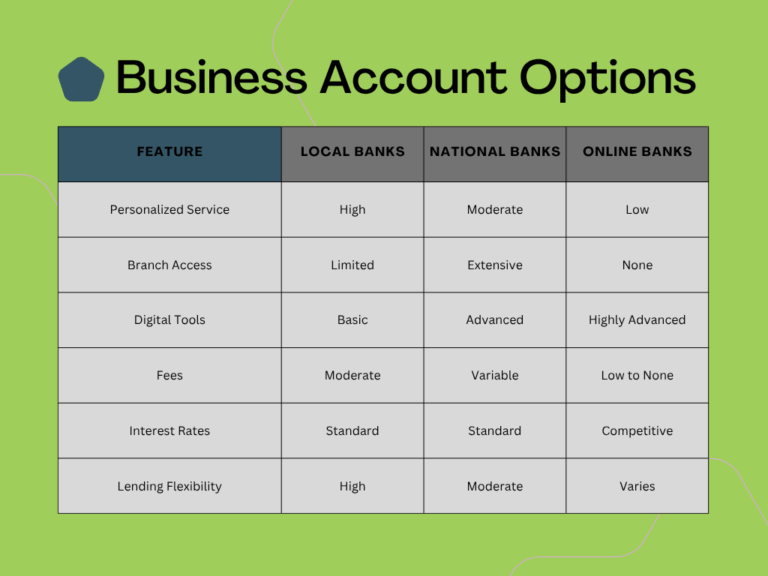

Option 1: Local Banks

Local banks can be a great choice for business owners who value personalized service and community relationships. These institutions often provide a more personal touch, understanding the nuances of the local market and offering tailored advice. For startups and small businesses, local banks may also present more flexible lending criteria, which can be beneficial during the early stages of growth. Additionally, being actively involved in the community, these banks may support local initiatives that align with your business goals.

However, they may lack the advanced online banking features that larger institutions offer. Their limited number of branches can also pose a challenge if your operations span multiple locations.

Option 2: National Banks

National banks are well-suited for businesses that require extensive accessibility and a wide range of financial services. They offer a comprehensive network of branches and ATMs across the country, which is highly convenient for businesses with multiple locations or traveling staff. Their digital platforms are typically robust, providing advanced tools for managing finances, integrating with accounting software, and streamlining operations. These banks also offer a variety of financial products including credit cards, business loans, and merchant services.

On the downside, the level of personalized customer service may not match that of local banks. Additionally, fees can be higher and maintaining certain benefits may require keeping large balances in your account.

Option 3: Online Banks

Online banks have surged in popularity thanks to their convenience, competitive interest rates, and lower fees. They are ideal for tech-savvy business owners who prefer to manage finances digitally. Online banks typically offer intuitive user interfaces, 24/7 account access, and seamless integrations with business tools. Their cost-effective structures allow them to provide better interest rates and minimal or no fees on business accounts.

Keep in mind online banks lack physical branches, which can be a drawback if your business needs in-person banking services. Cash deposits can also be more challenging, often relying on third-party networks or specific ATM access.

Conclusion

Choosing the right bank is a foundational step in establishing a successful business. By carefully evaluating your business account options—local, national, or online—you can select a banking partner that supports your financial goals and operational needs. Remember, the best choice is one that aligns with your business’s unique requirements and growth trajectory.

Want to learn more? Watch our video on choosing the best banking option for your business, and then check out our other videos to get practical insights and expert tips for every aspect of your business journey.

Frequently Asked Questions

Consider transaction needs, cash handling, lending requirements, digital tools, customer service, and fee structures.

Separating accounts simplifies accounting, enhances professionalism, and protects personal assets.

Yes, businesses can switch banks as their needs evolve. Ensure a smooth transition by coordinating the move carefully.

Reputable online banks are FDIC-insured and implement robust security measures to protect your funds.

Disclaimer

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting, or investment advice. You should consult a qualified legal or tax professional regarding your specific situation.