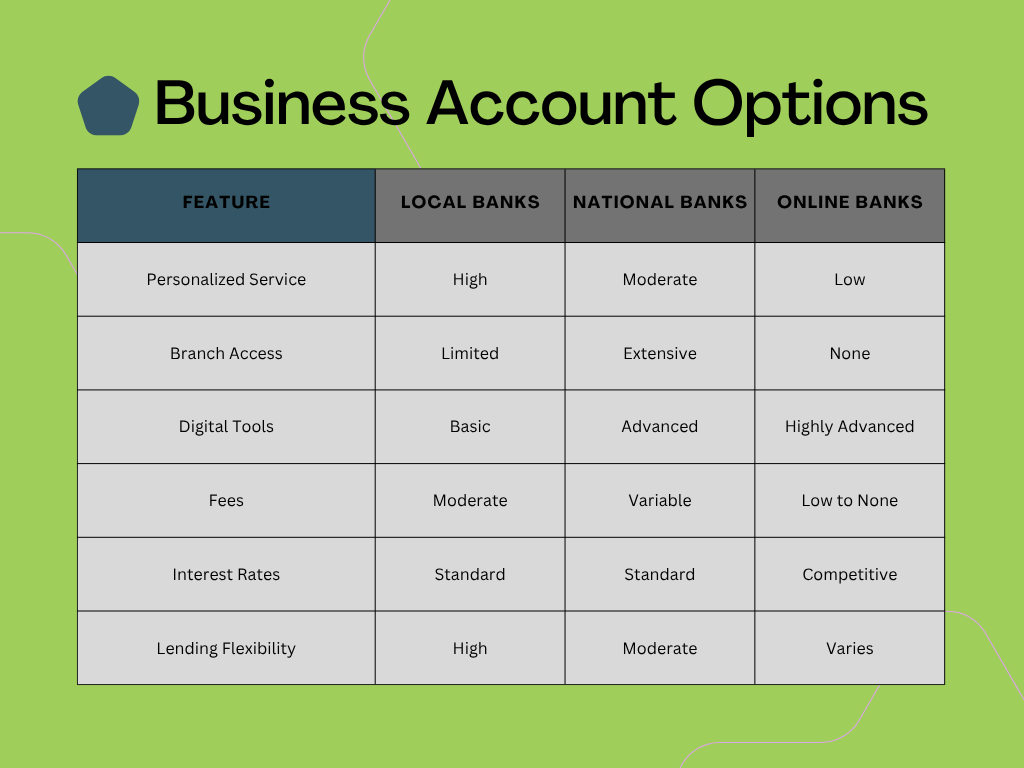

Choosing the Right Bank for Your Business: Exploring Business Account Options

Starting a new business involves numerous decisions, and selecting the right bank is among the most critical. The choice of a banking partner can significantly impact your business’s financial health, affecting everything from daily transactions to securing loans. With a plethora of business account options available, it’s essential to understand which type aligns best with your business model and goals.

Choosing the Right Bank for Your Business: Exploring Business Account Options Read More »